For Week Ending May 25, 2024

For Week Ending May 25, 2024

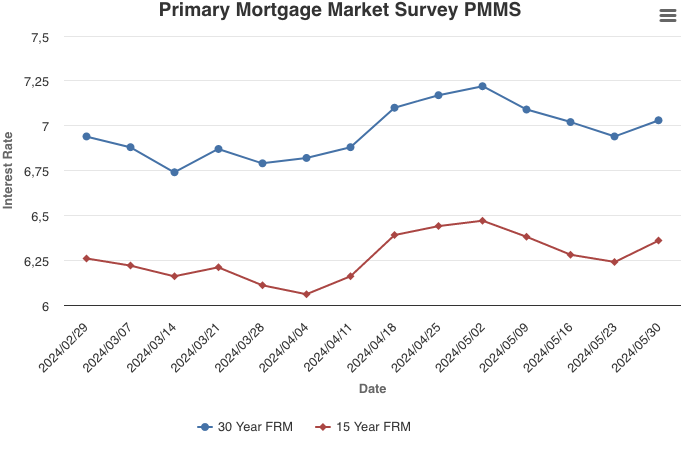

Prospective homebuyers received good news recently in the form of declining mortgage rates, which fell for the third consecutive week, offering consumers some relief amid persistent affordability challenges. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.94% the week ending May 23, down from 7.02% the week before, marking the first time since early April that rates have fallen below 7%.

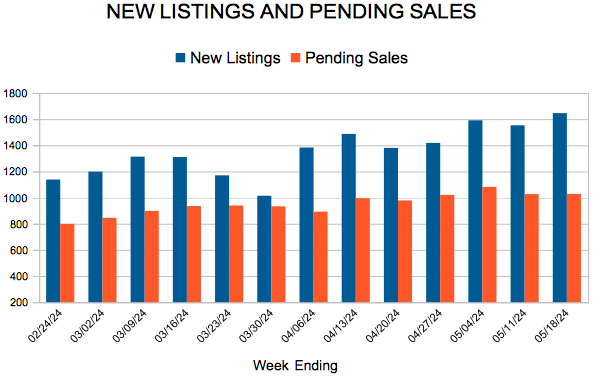

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 25:

- New Listings decreased 9.4% to 1,288

- Pending Sales decreased 6.6% to 1,127

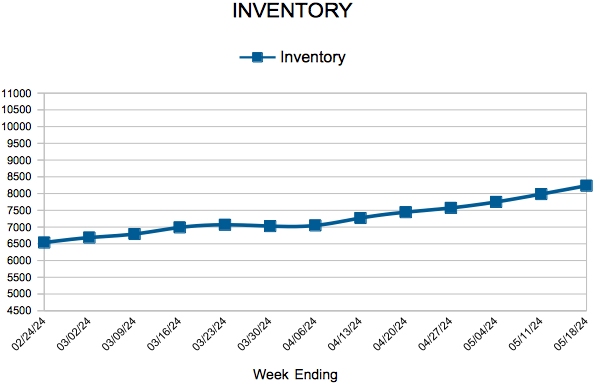

- Inventory increased 14.9% to 8,428

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Licensed In Minnesota

Licensed In Minnesota