Weekly Market Report

For Week Ending November 12, 2022

For Week Ending November 12, 2022

Homeownership was up slightly in the third quarter of 2022, with the percentage of owner-occupied households rising 0.6 points from the same period last year to 66% nationally, according to Federal Reserve Economic Data (FRED). The homeownership rate has continued to increase despite higher sales prices and a significant increase in mortgage rates this year, illustrating that buyer demand persists, especially in markets where the median listing prices were below the national median.

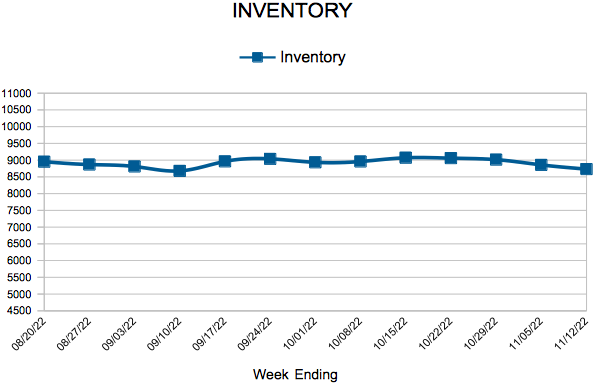

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 12:

- New Listings decreased 23.2% to 866

- Pending Sales decreased 42.8% to 691

- Inventory increased 8.6% to 8,732

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.1% to 98.2%

- Months Supply of Homes For Sale increased 26.7% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 5, 2022

For Week Ending November 5, 2022

With the average 30-year fixed-rate mortgage hovering around 7%, interest in adjustable-rate mortgages (ARM) continues to grow, as buyers look to save money any way they can. Freddie Mac reports the rate for a 5/1 ARM was a full point lower than the popular 30-year loan the week ending 11/4/22, while the share of homebuyers applying for ARMs has increased significantly since the start of the year, representing about 12% of total applications, according to the Mortgage Bankers Association.

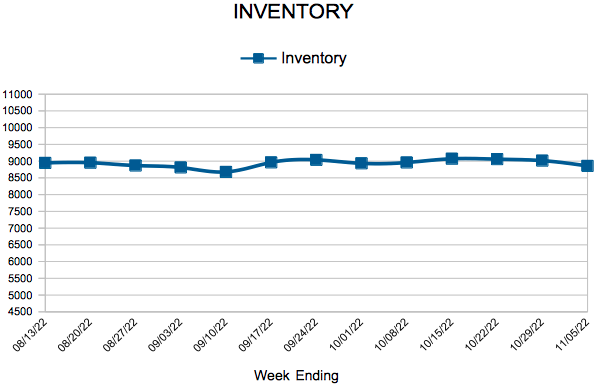

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 5:

- New Listings decreased 22.4% to 965

- Pending Sales decreased 37.4% to 751

- Inventory increased 7.8% to 8,858

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,100

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- Next Page »

Licensed In Minnesota

Licensed In Minnesota