Weekly Market Report

For Week Ending December 17, 2022

For Week Ending December 17, 2022

Mortgage rates continued their downward trend of recent weeks, as the 30-year fixed-rate mortgage averaged 6.31% the week ending 12/15, according to Freddie Mac. Mortgage rates have fallen for the past 5 weeks, declining by more than three-quarters of a percent in that time, and are at their lowest level since September. The drop in rates has resulted in an uptick in mortgage refinance demand, which increased 6% from the previous week, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 17:

- New Listings decreased 11.1% to 531

- Pending Sales decreased 23.2% to 633

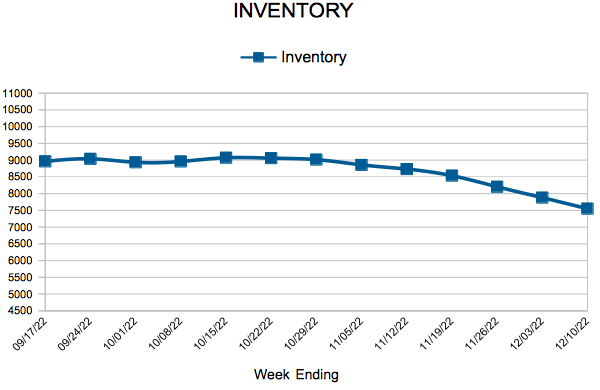

- Inventory increased 17.1% to 7,258

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 10, 2022

For Week Ending December 10, 2022

Conforming loan limits on mortgages acquired by Fannie Mae and Freddie Mac will increase in most of the United States to $726,200 in 2023, up from $647,200 in 2022, according to the Federal Housing Finance Agency. Meanwhile, the conforming loan limit in high-cost areas will increase to $1,089,300, exceeding the $1 million dollar mark for the first time. The increases in loan limits will allow a larger group of borrowers to qualify for loans backed by Fannie Mae and Freddie Mac.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 10:

- New Listings decreased 4.1% to 686

- Pending Sales decreased 27.1% to 604

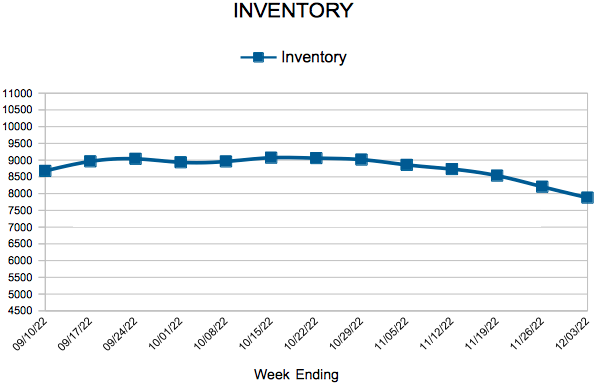

- Inventory increased 15.5% to 7,549

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 41.7% to 1.7

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 11

- Next Page »

Licensed In Minnesota

Licensed In Minnesota